Tecom Group Initial Public Offering

Creator of specialised business districts and vibrant communities across Dubai since 1999 will be listing 12.5% of its shares on the Dubai Financial Market

TECOM Group PJSC (“TECOM” or “the Company” or “the Group”) has formally announced its intention to float 12.5 % of its issued share capital on the Dubai Financial Market (“DFM”) through an Initial Public Offering (“IPO”).

Show more

Our integrated portfolio of high-quality assets across business districts strategically located throughout Dubai cater to 6 vital economic sectors. We create sustainable, vibrant ecosystems for our community members to thrive and collaborate in. Our array of bespoke commercial real estate solutions and value-added services are underpinned by state-of-the-art infrastructure, an enabling regulatory framework, seamless digital portals, and innovative working models to meet the needs of our business partners and to future-proof our business in an evolving work environment.

TECOM Group is a key contributor to Dubai’s economic diversification and development, attracting leading corporations, entrepreneurs, and specialised talent. With the support of our committed major ultimate parent shareholder Dubai Holding, we act as a key enabler of the Dubai government’s vision and strategic plan for the future of the Emirate.

Show less

With more than 20 years of successful growth and contributing towards Dubai and the region’s knowledge-based economy, TECOM Group is well-prepared to become a publicly traded company and is inviting eligible prospect investors to become part owners in the Company.

This webpage provides important, relevant, and up to date information on TECOM Group, its key investment highlights, and on the IPO process. We invite you to browse through the content and contact us for any queries not found on this site.

TECOM Group’s senior management team of seasoned executives have extensive operating experience in the real estate industry, with six out of the seven members having over 10 years of experience in the industry and four having over 10 years’ experience within the Group. In addition, a significant proportion of our senior management team has long-tenured board membership experience and experience working for publicly listed companies.

Tecom Group At a glance

As of 31 March 2022

10

Specialised business districts

6

Vibrant sectors

21.1mn sq ft

Total leasable area covered by built-to-lease properties

164.8mn sq ft

Total size of land properties, including available land bank

7,800+

Customers within TECOM Group’s business districts

82.8%

Average occupancy levels commercial leasing

87%

Average Value-Based Customer Retention Rate over the past 10 years (as at 31 December 2021)

100,000+

Professionals in our business districts

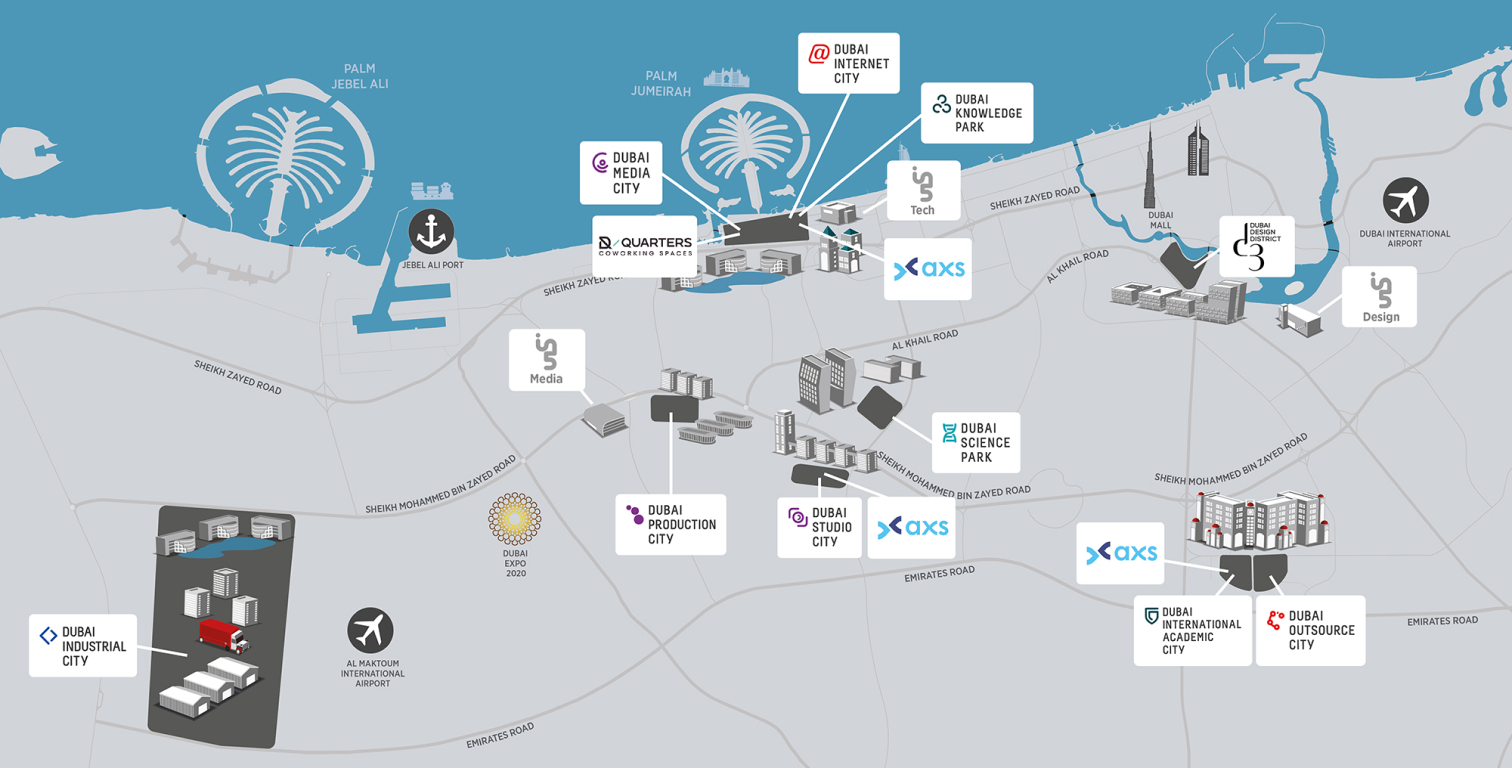

Strategically located across Dubai, our Business Districts cater to 6 vital economic sectors: Tech, Media, Education, Science, Design, and Manufacturing.

Dubai Internet City

A thriving tech community offering the right mix of commercial spaces, services, retail and events.

Dubai Outsource City

Enabling outsourcing customers to deliver BPO, HR Outsourcing, IT Outsourcing, back office and call centre operations.

Dubai Media City

Offers a regional hub for the media industry with state-of-the-art infrastructure and well-connected industry network.

Dubai Studio City

Provides sophisticated facilities and services to customers across the broadcasting, film production, TV, music, and entertainment sectors.

Dubai Production City

A community dedicated to fostering the growth of publishing, printing and packaging industries.

Dubai Knowledge Park

A source of training institutes and recruitment consultancy firms, offering a wide selection of programmes.

Dubai International Academic City

Home to internationally acclaimed universities, the business district is focused on nurturing the regional talent pool.

Dubai Science Park

Nurturing the growth of entrepreneurs, SMEs and MNEs the holistic community supports scientific research, creativity, and innovation.

Dubai Industrial City

Provides an enabling industrial ecosystem with integrated offerings of land, workers’ accommodation, and warehousing facilities.

Dubai Design District

A creative platform dedicated to design, fashion, architecture, art and retail.

A full spectrum of tech-enabled and fully integrated added-value products and services provide entrepreneurs, start-ups, and our business partners with prospects for growth and competitive advantages.

In5

An enabling platform for start-ups and entrepreneurs offering key benefits, such as business set-up, training, mentorship and more.

D/Quarters

A future-focused co-working space for freelancers, entrepreneurs, SMEs and global customers.

AXS

A business and government smart services platform which aims to facilitate more than 200 services under one umbrella.

GoFreelance

Supports freelance talent through a competitive package that includes opportunities to obtain new jobs and grow their network.

Financial Performance Highlights

*TECOM Group defines funds from operations (FFO) as cash flow from operations (including net financing costs and income) before changes in working capital

Operating Performance Segment

TECOM Group’s robust governance & ESG framework are at the core of our operating model. Our approach to ESG is centred around TECOM’s five ESG pillars:

8 out of 17 UN SDGS ARE OF PARTICULAR FOCUS

As a key player in one of the largest business segments in the UAE, TECOM Group is also committed to supporting several national mandates including:

- Solid ESG framework based on insights from internal and external stakeholders through our 2022 Materiality Assessment

- Energy audits and the implementation of a portfolio-wide utility monitoring and analytics platform to monitor energy and water consumption

- Projects for reducing energy consumption and operational carbon footprint, as well as investments in low-carbon energy sources

- Group-wide environmental policy and strict operating guidelines to limit the impact on the land and the surrounding areas in which we operate

- Sector-focused community investment programmes and policies as well as volunteering efforts

- Incubators and support for start-ups, SMEs, and freelancers to nurture talent and innovation in Dubai

- Experienced Board of Directors and an effective and transparent governance framework in line with international standards and regulatory requirements

- Risk Committee that will oversee the content of and approach to TECOM Group’s ESG framework and strategy, ensuring it is considered by the Board as part of the overall business strategy

- Transparent annual reporting on ESG as per the ESG reporting guidelines of the Securities and Commodities Authority (SCA)

June 2020

Dubai Outsource City solar carport activatedSEPTEMBER 2020

Dubai International Academic City carport activatedNOVEMBER 2021

Workers' accommodation (LV1) activatedDECEMBER 2021

Dubai International Academic City rooftop activatedMARCH 2022

Dubai Production City units activated

- Our strategically located and differentiated portfolio, supported by long term strategic tenants, has been an integral part of Dubai’s economic diversification and global competitiveness.

- Operating in Dubai, one of the most diversified and dynamic economies within the GCC region, will enable us to further capitalise on the Emirate’s unique positioning, favourable macroeconomic tailwinds, and supportive real estate fundamentals.

- TECOM Group offers a complementary portfolio of 10 business districts diversified across asset classes, sectors and communities situated in strategic locations in Dubai. These assets offer relevant connectivity, regulatory, and business enablement benefits across a large customer base.

- Our specialised community offering spans a range of price points for both CBD and non-CBD properties and offers attractive commercial office spaces, land leases, warehouses, worker accommodation facilities and associated retail which fulfil the infrastructure needs of six essential sectors: Technology, media, education, science, design, and manufacturing.

- Nine of our ten business districts are located in free zones, which allow for 100% foreign ownership.

- Our business districts allow for complete repatriation of profits and a range of industry-specific services.

- Our full-service offering has proved a top choice for over 7,800 customers, including major industry leaders, such as Meta (formerly known as Facebook), Google, Visa, BBC, CNN, Unilever, and Dior, among others.

- Due to our high-quality community and diverse customer base, we have achieved high levels of retention over the years.

- We have delivered robust financial performance and operational resilience through the cycle amid global and regional economic downturns, geopolitical instability and, most recently, the COVID-19 pandemic.

- We operate a stable yielding real estate portfolio in Dubai and our high-quality offering and diversified international and regional marquee customer base has driven healthy revenue and relatively stable EBITDA margins, with increasing cash conversion in 2021.

- Despite operating in a challenging operating environment during the COVID-19 pandemic, we focused on maintaining our occupancy rates, which remained relatively stable over the past three years, with our built to lease occupancy rates being 77%, 75%, 78%, and 81% as of 31 December 2019, 2020, 2021 and as of 31 March 2022, respectively.

- Our high-quality service offering resulted in stable EBITDA margins of at least 66% in each of the years ended 31 December 2019, 2020, and 2021. We managed to maintain those EBITDA margins during the COVID-19 pandemic through swift, focused, and effective counteractive operational initiatives implemented by our highly experienced management team.

- Our diversified asset mix and industry exposure eliminates significant concentration risk. Our portfolio is backed by stable, long-term land leases, attractive built to lease and built to suit commercial and industrial leases as well as a full range of ancillary services that cater to diverse industries and tenant needs, including companies, entrepreneurs, and freelancers.

Robust governance and sustainability framework to be further embedded in the core of the operating model.

- We place sustainability and environmental, social and governance (“ESG”) issues at the core of our operating model and our Group-wide ESG strategic initiatives are aligned with the United Nation’s Sustainable Development Goals and 2030 Agenda for Sustainable Development.

- We have also completed several solar energy projects across several business districts, such as Dubai Outsource City, Dubai International Academic City, and Dubai Design District. All have contributed to reducing traditional energy consumption and our carbon footprint.

TECOM Group’s dynamic management team has an extensive proven track record and a supportive shareholder.

- Our senior management team of seasoned executives have operating experience in the real estate industry, with six out of the seven members of our senior management team having over 10 years of experience in the industry and four of the seven members having over 10 years’ experience within our Group.

- A significant proportion of our senior management team has long-tenured board membership experience and experience working for publicly listed companies.

- With Dubai Holding Asset Management (DHAM) as our majority shareholder and Dubai Holding as our ultimate holding company, we benefit from the support of a committed major shareholder with a reputation for excellence in Dubai as a key driver of economic diversification and enabler of the Dubai government’s vision.

TECOM Group is offering an attractive dividend policy

- TECOM Group PJSC intends to adopt a semi-annual dividend distribution policy and to pay dividends in cash after the Offering in October and April of each year

- The Group expects to pay a dividend amount of AED 800 million per annum over the next 3 years (through to October 2025)

- It expects to pay the first interim dividend distribution of AED 200 million in October 2022 and expects to pay the second interim dividend distribution of AED 200 million in April 2023, which payments collectively pertain to the performance of the Group in the second half of 2022.

- Thereafter, interim dividends are expected to be paid in April and October of each year for the remaining dividend distribution policy period of AED 400 million for each interim period.

- All decisions related to distribution of dividend will be subject to Board and General Assembly approval

For further information on TECOM Group, please refer to the Local Prospectus available in Arabic and English under the 'Key Documents' section of this page. Please note only the Arabic-language Local Prospectus has been approved by SCA. The translated-English version of the Local Prospectus is provided for convenience only and does not constitute a legal document.

09 June 22

Announcement of Intention to Float on the DFM16 June 22

Offer Commencement Date & Price Range Announcement23 June 22

Closing Date of First Tranche (Retail Investor) and Third Tranche (Dubai Holding Employees)24 June 22

Closing Date of the Second Tranche (Professional Investor)27 June 22

Announcement of Final Offer Price29 June 22

Final allocation of First Tranche and Third Tranche29 June 22

SMS notification of final allocations of the First Tranche and the Third Tranche01 July 22

Commencement of refunds related to the surplus subscription monies to First Tranche and Third Tranche subscribers05 July 22

Expected date of listing the shares on the DFM|

1 |

Ensure you have your DFM National Investor Number (NIN) If you do not have a NIN, you can register for one instantly through eServices at www.dfm.ae or on the DFM Smart Services app. |

|

2 |

Learn more about TECOM Group Please read all the content provided in this microsite and in the Prospectus to learn more about TECOM Group. |

|

3 |

Make an informed decision You can make an informed investment decision once you have familiarised yourself with TECOM Group and discussed the details with your financial advisor. |

|

4 |

Subscribe to the Offering If you have decided that you would like to invest, subscribe to the Offering through one of the Receiving Banks, either through online channels, in a branch or by contacting your bank relationship manager. |

|

5 |

Allocation of shares Once shares are allocated, you may or may not receive full allocation of your order. Any excess will be refunded to you. |

- Individual Subscribers who hold a NIN with the DFM and have a bank account in the UAE.

- Professional Investors” (as defined in the SCA Board of Directors’ Chairman Decision No.13/R.M of 2021)

- Dubai Holding Group Eligible Employees

If you are interested in investing in DEWA, please contact one of the Receiving Banks listed below which are collaborating with the Company to help investors and shareholders.

Emirates NBD

Lead Receiving Bank

Emirates NBD Bank (P.J.S.C.), Baniyas Road, Deira

Po Box: 777, Dubai, UAE

Email: tecomipo@emiratesnbd.com

Website: https://ipo.emiratesnbd.com

Website: https://www.emiratesnbd.com

If you are interested in investing in DEWA, please contact one of the Receiving Banks listed below which are collaborating with the Company to help investors and shareholders.

Emirates NBD

Lead Receiving Bank

Emirates NBD Bank (P.J.S.C.), Baniyas Road, Deira

Po Box: 777, Dubai, UAE

Email: tecomipo@emiratesnbd.com

Website: https://ipo.emiratesnbd.com

Website: https://www.emiratesnbd.com

Ajman Bank

Al Ettehad Street, Next to Etisalat Building,

Mushairef Ajman, UAE

Email: info@ajmanbank.ae

Website: https://www.ajmanbank.ae/TECOM-IPO

First Abu Dhabi Bank

FAB Building, Khalifa Business Park – Al Qurn District

Po Box: 6316, Abu Dhabi, UAE

Email: ipo.online@bankfab.com

Mashreq Bank

Mashreqbank Global HQ, Plot No. 3450782

Umniyati Street (off Al Asayel Road), Makani # 2714487799

Po Box: 1250, Dubai Burj Khalifa Community

Dubai, UAE

Email: investorrelations@mashreq.com

Website: https://mashreq.com/tecom-ipo

Abu Dhabi Islamic Bank

Shaikh Rashid bin Saeed Street,

Po Box: 313, Abu Dhabi,

United Arab Emirates

Website: https://www.adib.com/tecomipo

Dubai Islamic Bank

Dubai Islamic Bank (Public Joint Stock Company), Head Office

Po Box: 1080, Dubai, UAE

Email: info@dib.ae

Website: www.dib.ae

Emirates Islamic

Head Office: Building No. 16, Dubai Healthcare City

Po Box: 6564, Dubai, UAE

Email: wealthmanagement@emiratesislamic.ae

Website: www.emiratesislamic.ae/ipo

Sharjah Islamic Bank

Sharjah Islamic Bank Tower, Al Khan Chorniche

Sharjah

P.O Box 4

United Arab Emirates

Commercial Bank of Dubai

Al Ittihad Road,

Port Saeed PO Box 2668

Dubai

United Arab Emirates

TECOM Group PJSC (“TECOM Group” or “Group”) has been developing strategic, sector-focused business districts across the emirate of Dubai since 1999. As part of Dubai Holding, TECOM Group is committed to enabling Dubai’s economic diversification and development, attracting leading corporations, entrepreneurs, and specialised talent.

The TECOM Group portfolio consists of ten business districts strategically located across Dubai catering to six vital knowledge-based economic sectors including technology, media, education, science, design and , manufacturing. The Group provides a varied and tailor-made portfolio which includes offices, co-working spaces, warehouses, as well as land lease, to over 7,800 customers. It also provides industry specialised facilities including media production facilities, laboratories, higher education campuses. In total TECOM Group’s land properties cover a total of 164.8 million square feet, consisting of 124.4 million square feet of land leases and 40.4 million square feet of land bank.

TECOM Group offers additional value-added services to deliver a competitive and attractive environment for businesses and entrepreneurs to thrive in and to facilitate engagement between the districts’ community members. Government and corporate services are made available through an integrated smart services platform, “axs”, enhancing ease of doing business and providing community members with a seamless experience. in5, its enabling platform for entrepreneurs and start-ups, offers innovation centres supporting tech, media, and design start-ups and SMEs. Its future-focused co-working spaces D/Quarters provide tenants with stimulating work environments and the “GoFreelance” package also serves approximately 2,400 freelance talents.

We consider our tenants and customers to be our business partners, dedicated to the common aim of realising Dubai's economic aspiration to establish the Dubai Emirate as a global hub for business and commerce. Our business partners include global and regional companies, SMEs, start-ups, entrepreneurs and freelancers.

For more than two decades, TECOM Group has leveraged distinctive know-how in developing exclusive projects for strategic tenants according to their specifications. Since 2016, we have delivered such projects for SAP, Samsung, Huawei, MasterCard and the University of Wollongong, University of Birmingham, Firmenich and Himalaya, which remain long-term tenants within their communities to this day. These developments are already fully contracted, provide highly visible income streams, and reinforce the Group’s financial profile.

Subscriptions open on 16 June 2022 and will close on 23 June 2022 for UAE retail investors of the First and Third Tranche. The subscription period for professional investors in the Second Tranche starts on 16 June 2022 and will close on 24 June 2022.

To apply for a DFM Investor Number (NIN), please use one of the following options:

- DFM App : For Individual investors only (excluding minors below the age of 21)

- eServices at www.dfm.ae: For all types of investors

- Dubai CSD Desk at DFM Trading Floor: For all types of investors. Opening times: Mon-Thu (8:30 am – 3:00 PM) & Fri (8:30am-12:30pm)

- Licensed Brokerage Firms at DFM: For all types of investors

For further information and guidance, please visit the DFM website https://www.dfm.ae/ and read through the DFM FAQs – https://www.dfm.ae/other/faqs

The Internal Shari’ah Supervision Committees of Emirates NBD Bank PJSC and First Abu Dhabi Bank PJSC have issued (or are expected to issue) pronouncements confirming that, in their view, the Offering is compliant with Shariah principles. Investors may not rely on these pronouncements and should undertake their own due diligence to ensure that the Offering is Shari’ah compliant for their own purposes.

The Global Offering is being conducted, among other reasons, to allow the Selling Shareholder DHAM, to sell part of its shareholding in TECOM Group, while providing increased trading liquidity in the Shares, raising TECOM Group’s profile within the international investment community.

Within five (5) working days of the Closing Date of the Second Tranche, the Offer Shares shall be allocated to Subscribers and, within five (5) working days of such allocation, the surplus subscription amounts and any accrued profit resulting thereon, shall be refunded to Subscribers in the First Tranche in the First Tranche and the Third Tranche who were not allocated Offer Shares, and the subscription amounts and any accrued profit resulting thereon shall be refunded to the Subscribers in the First Tranche and the Third Tranche whose applications have been rejected for any of the above reasons.

The surplus amounts and any accrued profit thereon will be returned to the same Subscriber’s account through which the payment of the original application amount was made. In the case of subscription amounts which have been paid by certified bank cheque, these amounts shall be returned by sending a cheque with the value of such amounts to the Subscriber at the address mentioned in such Subscriber’s subscription application.

The difference between the subscription amount accepted by TECOM Group and the Selling Shareholder for a Subscriber, if any, and the application amount paid by that Subscriber will be refunded to such Subscriber pursuant to the terms of this Prospectus.

Please refer to the full FAQs for more information.